Intel Grossly Exaggerates Foundry “Wins” With Qualcomm And Amazon, There Are No Deals For Manufacturing Chips

Intel drew up a big stir recently when they announced their process technology and packaging roadmaps. Possibly the most exiting news of the Intel Accelerate 2021 event was that they had over 100 customers in the pipeline with 2 wins already. Amazon and Qualcomm were becoming customers of Intel Foundry Services. While at first glance these names seem like huge wins, the size and scope of these agreements are much smaller than Intel portrays.

Amazon is only a packaging customer. A big positive for Intel´s packaging prowess, but this explicitly means that Amazon will not be manufacturing chips at Intel. The chips themselves will still be fabricated at other foundries such as TSMC. We believe this win is specifically related to networking and silicon photonics.

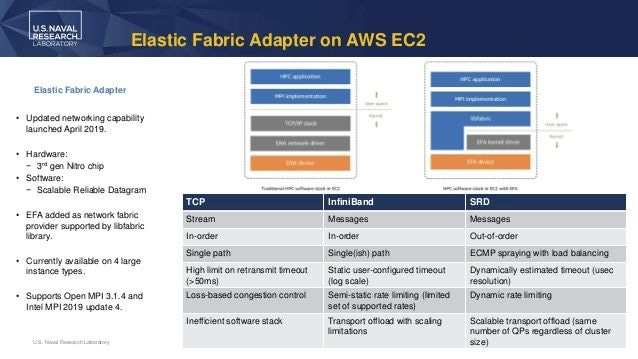

Amazon has a robust pipeline of Network Interface Controllers (NICs) development with 400Gbe already deployed. These NICs run their own proprietary protocol which is touted as better than the standard Ethernet or InfiniBand protocols. The Intel competencies around co-packaged optics are likely driving wins here for future Switch and 800Gbe+ NICs.

We wrote about their technology lead in silicon photonics and explained why it is Intel’s Trojan Horse for entering the foundry business model. While it is a nice win, packaging for specific datacenter infrastructure hardware is not anywhere close to as important as manufacturing chips or selling merchant silicon directly to Amazon.

The bigger exaggeration is the Qualcomm announcement. Intel touted them as a customer for their 20A node. This seems like a massive win given Qualcomm is a top 5 fabless semiconductor company and a fast mover to new process technologies. If Intel were to manufacture leading edge smartphone chips for Qualcomm, that would be a huge check mark for the validity of their claims. Unfortunately, 20A is a 2025 process technology assuming no delays, which puts actual chips many years away. In the past, Qualcomm stated similar things about the Samsung 7nm, but they used it on a single chip, 735G, which was an upper midrange SOC that was relatively low volume.

Regardless, Qualcomm throwing down the gauntlet like this would signal big beliefs in Intel’s roadmap. That of course begs the question to Qualcomm, what the plans are, and what is the agreement, how much volume, is it related to the subsidies? When Qualcomm was questioned, the answer was quite disappointing.

Question:

Just given the recent Intel announcement where you're partnering with Intel on IFS, what sort of commitment is this on your part? Is that sort of a volume commitment at this point? I realize it's some ways out, but would it be fair to say that it's going to service the U.S. consumer?

Answer: Cristiano Amon -- President and Chief Executive Officer

Thanks for the question. Look, it's actually very simple. Qualcomm, we're probably one of the few companies that, given our scale, is able to have multi-sourcing at the leading node. We have two strategic partners today, which is TSMC and Samsung.

And we're very excited and happy about Intel deciding to become a foundry and investing in leading node technology to become a foundry. I think that's great news for the United States fabless industry. We are engaged. We are evaluating their technology.

We don't yet have a specific product plan at this point, but we're pretty excited about Intel entering the space. I think we all determined that semiconductors are important and resilient supply chain is only going to benefit our business.

Qualcomm has no product plans! They are simply discussing and evaluating the technology with Intel! If this is enough for Intel to call them a customer, how far along are discussions with the 100+ potential customers they touted. To SemiAnalysis, Qualcomm sounds like they are just another a potential customer. There isn’t any actual foundry deal in place.

What was the motivation for claiming a customer here when its clearly still in the evaluation stage?

Pretty simple, Intel gets to tout the win and keep pushing the narrative that Intel is on the comeback after stagnating for years. Intel’s 20A node looks like a real technology rather than a node with huge unproven technologies such as RibbonFET and PowerVia. The narrative shifts and Intel stock holders can be excited about the future, even if the actual business is losing market share rapidly.

Qualcomm on the other hand gets to use this as a negotiation point with their existing foundries. It is no secret that Qualcomm has heavily utilized Samsung and TSMC while playing them off each other. This allows them to choose the most cost-effective process nodes for the technology goals they have. Another bargaining chip will keep TSMC on their toes for technological development and ensure Samsung continues to undercut on wafer pricing.

Regardless of the motivation, it is very clear that Intel exaggerated to investors and technology lovers. There is no deal to manufacture Amazon designed or Qualcomm designed chips. They are offering packaging services to Amazon and are simply being evaluated by Qualcomm as per their CEO. Pat Gelsinger said this.

There have been many, many hours of deep and technical engagement with these first two customers, and many others.

He also said during the announcement that the Qualcomm deal involved a "major mobile platform."

Bold faced lies!

We thought Pat Gelsinger would stop the charades with investors, but after Monday’s announcement, we are quite disappointed some of them are continuing. Let's cross our fingers and hope this gross exaggeration doesn't lend itself to the claims about packaging and process technology as well.

This article was originally published on SemiAnalysis on July 29th 2021.

Clients and employees of SemiAnalysis may hold positions in companies referenced in this article.

Thanks for checking on this story

I believe Intel, they never lie.