Semiconductor Roundup - 1/27/2022

Intel, Teradyne, Lam Research, Wolfspeed, Texas Instruments, UMC, Xilinx, Samsung, MediaTek

This will be our first of this type of post, but a flurry of semiconductor earnings releases and calls are happening now. Quite a bit of interesting news is coming out and we’ve got a lot of takes and analysis. In this post we will cover Teradyne, Lam Research, Wolfspeed, Texas Instruments, UMC, Intel, Xilinx, Samsung, and MediaTek. I recommend you read all of them given the most interesting parts are what you can read through about other firms in the supply chain that sometimes are seemingly even unrelated.

Teradyne

Teradyne had a good 2021, and they claim that there has been no test equipment installed for the upcoming boom in semi spending. The most interesting part of the earnings release was this quote.

However, in 2022, we expect a slower technology transition in one of our major end markets to result in lower System-on-a Chip test demand for Teradyne before accelerating again during the ramp of 3nm production in 2023.

We have known Apple would not be releasing an iPhone with TSMC N3 for quite some time. The news here should have been known coming a mile away because how Apple heavy Teradyne is. Teradyne is going to hurt in the short term on earnings due to test intensity falling due to lack of node shrink.

And we didn’t even get into the the huge sales by insiders… not a good look at all for Teradyne.

Advantest should fare much better in 2022 as they are not Apple heavy. While other smartphone SOC suppliers such as MediaTek and Qualcomm do go through major node transitions, these transitions will not be as test intensive as Apple’s due to the nodes already being ramped and yielding well. The brightest spot will be RF testing for WiFi 6E and WiFi 7.

Lam Research

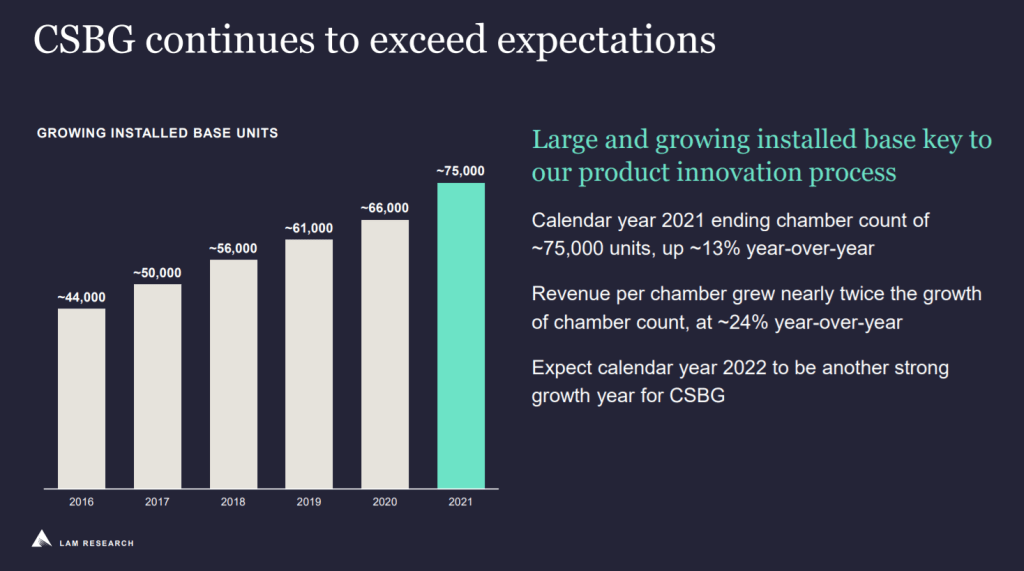

Lam Research had an incredibly bad quarter, and they missed earnings by quite a bit. This wasn’t due to demand slowing down. In fact, their order backlogs continue to grow, and the deferred revenue bucket is now at $1.46 billion. The issues is all supply chains. Lam stated they could have as much as another $500 million of deferred revenue due to continued supply chain issues in the next quarter. Lam also seemed certain 2023 would be higher wafer fab equipment spend versus 2022 due to all the shells being built out that would then take in tools and various customers commitments.

Lam is a bit odd in how they count wafer fab equipment spend as they count mid-$80 billion for 2021 when the actual industry spend seems to be more like $94 billion. With that in mind, they believe 2022 will be $100 billion for 2022. If we apply the 18% higher delta of real WFE to Lam's definition than the real 2022 number would be $110 billion of wafer fab equipment! Kind of a backwards way of arriving at this number, but I have $113 billion given no more major supply disruptions in 2022 using a different methodology.

A big part of the miss from Lam was lockdowns in China. With Yangtze Memory Technology Corporation in Wuhan, Micron and Samsung in Xian, Intel’s old NAND fab that is now owned by SKHynix in Dalian, and SMIC all over China, there were a lot of opportunities for disruption. These disruptions partially caused NAND to fall from 45% of Lam's revenue to 35%. China's contribution to revenue fell from 37% of revenue to 26%.

Nikkei reported major news yesterday, but the fab project was long since dead and was never embedded into Lam's forecasts.

The second project to be ditched was in Chengdu, Sichuan Province, where Tsinghua Unigroup planned to build a $24 billion facility for 3D NAND flash memory chips, according to government documents and sources briefed on the matter

Lam Research also blamed a supplier for more than $200 million of missed shipments. We named supplier behind the subscriber only wall. In addition, behind the wall is a semiconductor capital equipment firm that is exposed to this exact same issue. These disruptions seem to be constant, but slow alleviation of supply chain issues will mean the back half of the year will be especially high for wafer fab equipment shipments.

Lam Research has an expansion in Ohio for a parts facility, which I found especially interesting given the fact that Intel has just announced a mega-fab in the state. The “silicon heartland” as Pat Gelsinger coined it, is already coming to fruition.

Lam Research is going to grow into one of my largest holdings. Any price under $550 is an instant buy. Lam sits in a very advantageous position in the semiconductor capital equipment world with their dominating position in 3D NAND. NAND has had steady 30%+ bit growth annually, but capex hasn't increased much in recent years. Interestingly enough, the more efficient a firm's tools are, the less a fab will buy. Scaling trends in NAND have allowed layer counts to grow to 192 layers with relatively low capex intensity, but beyond 192 layers, capex intensity should start to increase. When share gains in Foundry/Logic/DRAM are stacked on, it starts to become especially appealing. For example, Lam's selective etch platform will double in revenue this year, and it is critical in many parts of semi, especially with the transition to gate all around transistors.

Lam’s business will accelerate through the year and margins will improve. The customers want way more tools than can be reasonably produced give the supply chain issues, and Lam could be poised to outperform even without the technological argument given they will have the most incremental capacity for etch and deposition tools with the new Malaysia facility.

In the future, I will be detailing these share gains on a market-by-market basis because Lam has not done a good job at telling this story. At the same time, I’m also not complaining if the price of Lam stays depressed for a bit, Lam is clearly gearing up for some gnarly repurchases and they have the cash + cashflow to do so. Depressed share prices are good for long term shareholder value.

And because we here at SemiAnalysis love to smack down Morgan Stanley, here is my favorite excerpt from the call transcript where a Morgan Stanley analyst asks a dumb question after not having paid attention during the first half of the call.

Wolfspeed

The story with Wolfspeed this quarter is quite simple. Margins creeped up, RF + 150mm substrate businesses are doing well with $100 million of unmet demand, and they continue to make progress on 200mm. The Mohawk Valley fab is starting to become a reality. Test wafers will start processing this quarter.

The only important number from these earnings was that they received $1.6 billion of design-ins last quarter. The vertically integrated device narrative is the only story makes the Wolfspeed stock work. SemiAnalysis believes Wolfspeed raises capital in late 2023 to fill out the rest of the Mohawk Valley fab. We also believe that Wolfspeed could use this raise to break ground on the 2nd fab at the same site targeting high volume production in 2026.

Texas Instruments

TI did great as usual, and the content growth story keeps chugging. Industrial are up 40% year over year, automotive was up high single digits, personal electronics was down upper single digits, communications equipment was up 25%, and enterprise systems was up 50%.

Industrial is 40% of TI’s business. Putting up 40% growth numbers in this segment is just bonkers. There was also strong growth in the communications segment. Industrials + non-smartphone communications is what is lumped into internet of things and edge at other firms. Other firms will likely do very well in this segment as well. I give my top pick for this in the subscriber only section.

Automotive wasn’t as strong as previous quarters. Automotive is starting to show that shortages, at least from TI’s end, are mostly gone. We are approaching steadier long-term growth rates rather than crazy catch up growth. The personal electronics segment was horrible, even accounting for seasonality of this business. personal electronics read throughs may be poor in the Android camp. Apple supply chain had some gnarly inventory builds from the most recent iPhone cycle, so there could just also be some digestion of that inventory.

Lastly, the lion in the room, enterprise (read datacenter). While datacenters do not have much analog content, the 50% growth is very important to read through regardless. Companies that are datacenter levered are going to see great growth.

TI also has started to build inventory. Their inventory is way below the level it used to run at pre-shortages but going from 112 days to 116 days is something to note. Especially given that TI has put the pedal to the metal on capital expenditures. TI is building out multiple 300mm wafer fabs. Investors may not like the capex spend much, but thankfully TI is thinking a bit longer term.

CapEx has been going up and will continue to go up over a number of years with those investments that I mentioned. Those are long-term investments. Those are going to set us up great for the next 15-plus years. So I'm very happy about this. I'm pleased with that. We're confident about those. But that does flow through the P&L as higher depreciation. So I expect CapEx to go up, and depreciation will follow. And that will have an impact on gross margins. But frankly, at the end of the day, that's accounting. The investment is happening now. It will happen over the next few years with that additional CapEx, and that will just put us in a great position to grow the top line and have really great fall-throughs over a long time to come.

UMC

UMC continues to run at 100% utilization, sign longer term agreements, slowly expand supply, and increase price quite a bit. Prices were already up about 16% last year and Q1 comes with another 5%. More prices will come through the rest of the year as well. Capacity is so tight, UMC can dictate some pretty favorable terms. UMC believes oversupply would come "beyond 2023", and they believe they are well positioned due to long term agreements.

Intel

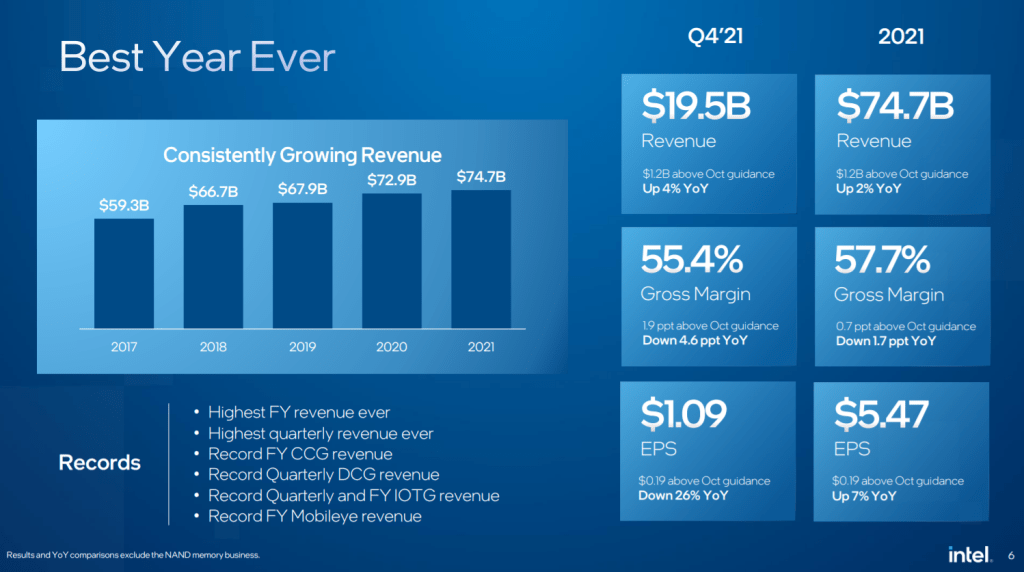

Intel is playing out how most people expect it, but there are some interesting details in the earnings. Intel continues to beat their guidance and make buckets of cash, but Intel’s stock went down. The Q1 2022 guidance has a 49% gross margin guidance which is the lowest Intel has seen since at least the global financial crisis.

These horrible, 49% margins are despite Intel’s average selling prices in server, laptops, and desktops are increasing. The 10nm ramp of Alder Lake desktop, mobile, and Ice Lake server are the culprits. Intel has products that can sell at somewhat higher prices due to the current semiconductor market environment, but their manufacturing costs on 10nm are still very high. Intel claimed their 10nm manufacturing costs were down 30% year over year, but all that tells us is that the starting point was horrible. Intel is also blaming the low margins on expenses related to the start up of their Intel 4 node.

Lastly on margins, Intel is ratcheting up stock-based compensation to match the rest of the semiconductor industry. Intel salaries are generally competitive, but they pay very poorly in restricted stock units (RSUs). Intel isn’t increasing RSUs across the board. 2 major groups are receiving outsized increases, Long Term Development (LTD) and the design organizations. LTD is the process group that takes technologies from the research group (components) and develops them all the way to ramp, and design organizations are the designers and architects of the chips. Pay increases are being put where they are needed the most, process and chip design. Groups such as marketing, non-development product teams, components research, HVM manufacturing, and administration are receiving smaller increases.

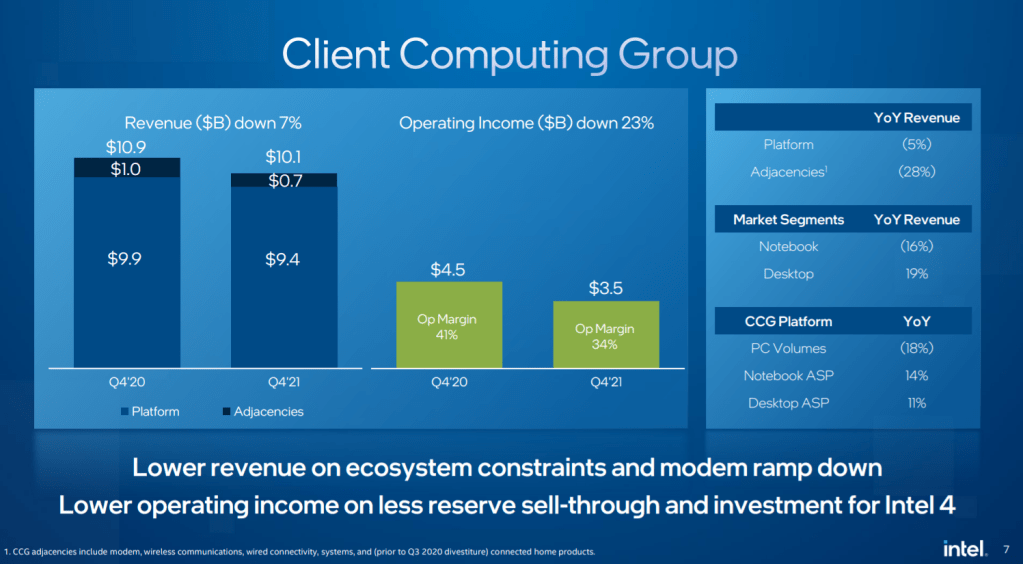

Client computing group had a spectacular quarter with all things held equal, but there is quite the dark spot in notebooks. Revenue is down quite a bit despite ASPs soaring. This implies really poor volumes. Desktop had strong growth due to the new Alder Lake desktop ramp. Adjacencies are down quite a bit due to the sale of the home gateway group to MaxLinear (which MaxLinear got for a steal of a price) and the ramp down of the 4G LTE modem business.

Intel’s inventories went up significantly and Intel dodged the question when asked. They talked up the big rotation from Chromebook sales to higher end laptops, increased competitiveness (AMD share gains), the home gateway drawdown, and a major customer going vertical (Apple). None of these were satisfactory answers. We believe that their inventory is way up due to laptop ODMs not being able to secure enough other components and choosing to buy as much AMD as possible while letting Intel only supply the remaining demand.

Tiger Lake laptop chips are now at more than 100 million shipments, and so we wanted to compile all the times they made statements about volume. Modeling out the number of wafers ran isn’t a difficult task.

3/23/21 – Intel Unleased – Tiger Lake continues its strong ramp with nearly 30 million units shipped

7/22/21 – Q2 2021 – Tiger Lake is ramping even better than expected with more than 50 million units shipped to date.

10/26/21 – Q3 2021 – Tiger Lake has shipped more than 70 million units this year

1/26/22 – Q4 2021 – Tiger Lake, which has now shipped over 100 million units

The datacenter unit had solid revenue growth, but lower income due to poor margins and a one time charge for missing the Aurora supercomputer delivery date. The real kicker is that cloud revenue has shrank year over year for 5 quarters in a row. Enterprise and communications really bailed out Intel. Intel claims they shipped more than 1 million Ice Lake server chips which is more than they shipped in the last 3 quarters combined. Despite Ice Lake server launching in the first half of the year, the actual ramp was only Q4. Intel tried to brag with the following comment, but it really sounded pathetic because they couldn’t really say anything about preventing future share losses.

We expect that our Xeon shipments in December alone exceeded the total server CPU shipments by any single competitor for all of 2021.

Patrick Gelsinger

One very odd comment Pat Gelsinger made on the call was that Sapphire Rapids is cheaper than AMD’s Genoa and that it had a better cost structure. All I can say is that Pat is nuts if he thinks Sapphire will command better margins. It should be cheaper to manufacture (there are multiple configs, not just the 1600mm2 behemoth), but it will not be able to command the same price bracket as Genoa.

Also, something is up with Intel's ethernet, photonics, and base station business. Where is the growth they promised? These markets should be growing a lot faster than the paltry numbers put up by the adjacencies section. I don’t want to sound the alarm bells, but why is it significantly undergrowing the end markets…

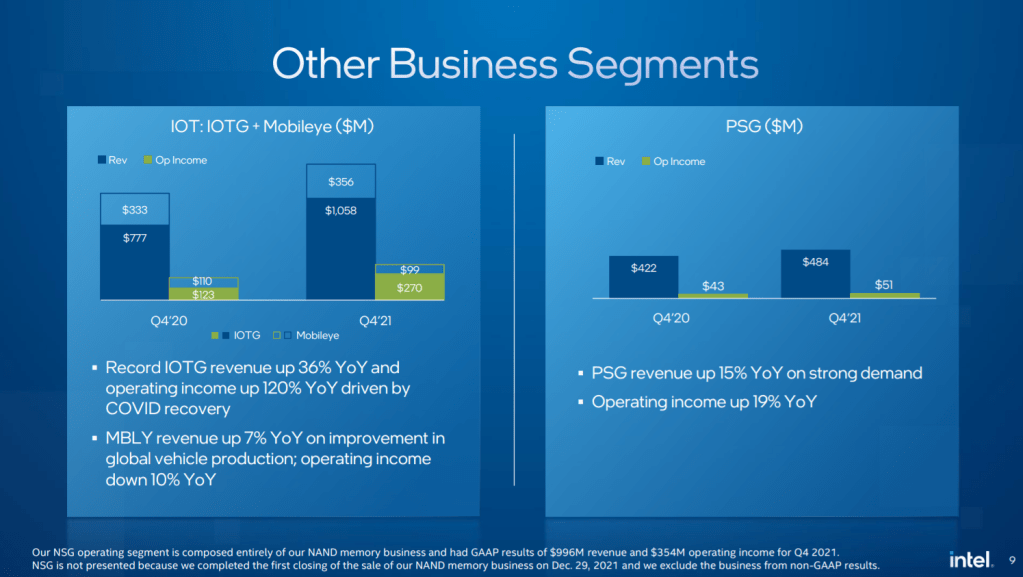

Intel’s golden child of Mobileye was quite sluggish aswell. It recorded only 7% higher revenue and lower operating income. Due to this sector doing a partial IPO soon, the poor numbers here hurt a lot. If this slowdown is sustained, then there is no way it gets anywhere close to a $50 billion valuation like Intel is hoping for. Intel drummed their chests about 100M Mobileye EyeQ SOCs being shipped over its lifetime. More importantly they announced they are now piloting autonomous vehicle test fleets in New York, Munich, Detroit, Tokyo, Israel, China, and Paris. Commercial robotaxi services launching in Munich and Tel Aviv in 2022. This seems to be ahead of even Waymo as far as geographic diversity of testing and deployment.

IOTG is the rockstar and is doing really well, not much to say here besides that it is the best part of this earnings report. See Texas Instruments earnings detail for more information as to why. Analog isn’t similar at all to IOTG business, but some of TI’s end markets are the same.

Xilinx / Intel PSG

Intel’s acquisition of Altera and execution since has been horrible. This quarter was especially sad for them. Xilinx had tremendous growth and hit over $1 billion for the first time this quarter, meanwhile Intel’s Programmable Solutions Group continues to flounder at less than $500 million in revenue. Xilinx also grew 81% year over year in the datacenter, which is just bonkers numbers. My guess is that Microsoft pulled in another round of FPGAs for Project Catapult as they begin their next datacenter buildouts.

One could blame issues with Intel’s 10nm like they do everything else in the company, but that isn’t the case. Versal and Zync, the leading-edge FPGA’s from Xilinx are only 28% of Xilinx. Intel truly and royally fucked up Altera on lagging FPGAs, not just leading edge. It’s no wonder so many of the Altera heads left, some even to go to AMD.

Intel claimed $500 million in lost sales, but our channel checks reveal Xilinx FPGAs have longer lead times, so if anything, Xilinx has more unmet demand and share figures would be even worse. Despite all the positive talk, I think the best outcome for AMD in the acquisition of Xilinx would have been for it to be blocked. They are overpaying through the nose even after falling ~30% in the last month. The deal got China approval today, so it looks like it will close, but I do not like the deal.

The last thing I will talk about is the new reporting segments that Intel is establishing. It really cleans things up and gives them a new slate. There 6 segments now. Client computing remains mostly untouched, but Intel did add the workstation business in. Datacenter and Artificial Intelligence comprises of datacenter CPUs, Programable Solutions Group, and I presume Habana Labs. 2 poor acquisitions being lumped in with what used to be the golden goose, but now is facing tough competition. Interesting that they stuffed as much garbage as they could into this group.

The new network and edge group is probably my favorite. The IOT group and all networking focused products such as base stations, photonics, IPUs, and ethernet will be pulled in. This group is stellar, and I look to it being a key growth driver in the future.

Mobileye is also one of my more favored segments despite the weak quarter. This is unchanged.

Accelerated computing and graphics is another new group and it will comprise of all discrete graphics products. This is the culmination of Raja Koduri and really puts fire on him. His business unit is now a separate reporting segment with its own P&Ls. Never has he had this, and he really needs to make it shine now.

Intel Foundry Services is the last group. It will have all wafer and packaging revenues for outside clients. The packaging revenue already started in Q4 as we reported in an earlier subscriber only article. I am happy that Intel is going to break this business out from day 1. It seems like they can stuff a bunch of costs into this and the GPU groups for a while and push the story that they are ramping businesses. Maybe that will work for some investors.

Intel explained that the foundry services unit would have weaker margins versus the other business units. They also explained that there are customer test chips running on Intel 16 this year. They announced that the Intel 18A process node (the first node with High NA EUV), has had its process design kit released to 3 RAMP-C customers. Given this is a government program, it is hard to guess who, but we do have confirmation that Qualcomm is one of them.

Intel claimed they manufactured more than 2 million wafers in 2021, which is basically all leading edge. There will be a tiny bit of legacy business and photonics, but the vast majority is 14nm and below. For reference, this is a good bit more that TSMC’s N5 node, and even a bit more than the TSMC’s N7 node. Of course TSMC runs many nodes at volume, especially trailing edge, and so their total wafer counts are at 14 million in 2021.

Intel capex will be more weighted to metrology and chemical infrastructure within the fab versus the rest of the industry due to their difference in number of node ramps and desire to have extra empty fab shells.

Samsung

There is way too much with Samsung to cover in the DRAM and NAND markets, especially given they never give concrete guidance. One item did stand out which that could explain part of Intel’s poor performance in the DCG adjacencies business, namely the 5G base stations. Samsung talked about winning European business, which could mean Intel lost 5G base station share in favor of Samsung’s own silicon.

Samsung spent the most on semiconductor capex in 2021 to the tune of $36B. Most of this is for memory, not logic.

MediaTek

MediaTek is near and dear to my heart because the first article on www.SemiAnalysis.com was literally me making the case MediaTek was undervalued and poised to gain a lot of share. And well they did! MediaTek is guiding 20% growth for 2022. This may be the year they eclipse Broadcom in revenue. 5G penetration in China is nearly complete at 80% which is why growth is slowing down a ton, well that and the fact Huawei is fully displaced. 5G units outside of China will double according to MediaTek, which will be a big boom for content and ASPs. A crazy comment is that they are shipping decent volume to the US, a former Qualcomm stronghold due to patents. MediaTek is also raising prices in some lines, but 5G ASPs will not increase. The mix of 5G to 4G continues to be the story.

In addition to smartphone, the MediaTek WiFi business is killing it with WiFi 6 and 6E. The power and IC angle is really growing nicely too. They are starting to rack up wins in industrial and auto which is quite interesting. I imagine these are PMICs, not actual high-power ICs. Smart Edge unit encompasses everything from IOT to custom ASIC business to the aforementioned WiFi. I really like this unit, and it should eclipse smartphone in the next few years.