Q3 Earnings Ends With A Bang – $NVDA $MU $KLIC

Micron, Nvidia, and K&S Join Forces For The Most Negative News Day Of The Cycle

If we map all the days this year and for the current semiconductor cycle, a handful of gloomy days stand out. Micron’s original puke, Intel’s mammoth Q2 miss, AMD’s guidance cut, and China AI & Equipment regulations, 2 weeks ago when Entegris and RFFE guys had terrible numbers. Each of those were bad, but today might be the worst day of news flow. The companies we want to update on are Micron, Nvidia, and K&S. 2 of these 3 companies had negative moves following their news, while Nvidia oddly is up after hours.

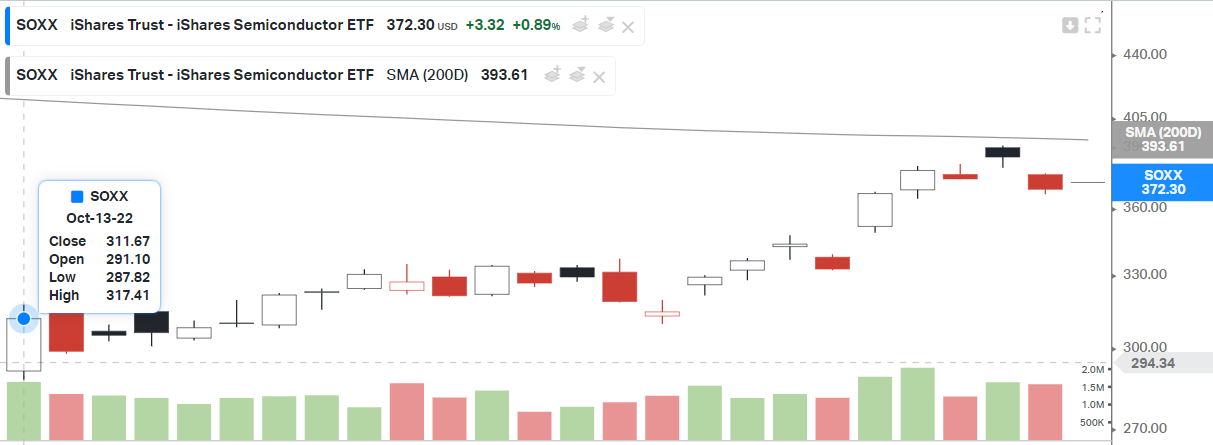

With all the bad news, the market reaction for the general semiconductor industry was expectedly horrible. SOXX has had an incredible rally over the last month. From October 13th to November 15th, the Intraday low (287.82) to the high (390.59) was a 35% increase. Today’s news and reactions could indicate that the recent bull run for SOXX is over. As an aside, we generally don’t care to discuss short-term movements in the market, but this ~1 month move has been titanic, and it seems we are overextended.

Kulicke & Soffa – KLIC 0.00%↑

KNS is down a considerable amount today. The current quarter was fine, with revenue at revenue $286.3M vs. consensus $277.0M and EPS at $1.19 vs. consensus $0.98. The big kicker was Q1’s revenue at $175M +/- $20M vs. consensus at $244.4M. EPS at $0.20 +/- 10% vs. consensus $0.82. Compare this to Q1 this year, revenue was $460.9M, and EPS was $2.11. The guidance incorporates an absurd year-on-year decrease.

Revenue $460.9M -> $175M!

EPS $2.11 -> $0.20!

Due to a combination of macro and industry-related factors, K&S continues to anticipate a period of capacity digestion for its high-volume assembly solutions over the coming quarters.

The scariest part is that there is a tremendous oversupply of wire bonders at Tier 2 and 3 OSATs, and this digestion will feed well into 2023. This isn’t a one quarter inventory digestion cycle. As Rohinni miniLED and microLED transfer tools gain share, the relatively decent sales in the display segment could also weaken materially.

Micron – MU 0.00%↑

Micron reported earnings already, but they put out another press release to level set expectations as the rally there has gotten out of hand about the timing of the bottom. Micron’s announcement was about them cutting wafer starts by 20% in Q4. While Samsung and SK Hynix are also cutting wafer starts, it’s not to nearly the same degree as Micron. There is some share loss here.

Micron is also working toward additional Capex cuts. In calendar 2023, Micron now expects its year-on-year bit supply growth to be negative for DRAM, and in the single-digit percentage range for NAND.

As a reminder, Micron already cut Capex for fiscal 2023 by 50%. This indicates they are making even more significant cuts. You have to go back to before even the financial crisis. In the great financial crisis, even though prices fell as much as 75% in some segments, bit growth was still 21%, as per IC Insights in 2009.

Micron is guiding supply growth as NEGATIVE.

Given the modern dynamics of the DRAM industry, the magnitude of an inventory issue and the corrective actions to correct that inventory issue are enormous.

Micron is tanking expectations by a massive amount.

As discussed in the history and timeline of flash memory, bit growth has been over 30% annually for over a decade.

Instead, Micron is guiding single digits bit growth for NAND now.

This means NAND WFE is likely down >70% at Micron, and DRAM WFE should be near 0 outside of any EUV and Litho commitments they have made. Micron likely continues to build the shells, but possibly cuts out on materials infrastructure as well.