NXP Semiconductor (NXPI) CFO Sells Nearly 70% Of His Shares As Samsung Acquisition Rumored To Fall Apart

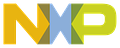

NXP, the world leader in automotive semiconductors has been rumored to be acquired by Samsung for quite some time. The rationale is that Samsung wanted to move into the automotive industry as the semiconductor content per vehicle skyrockets from $100’s per car to $1000’s. NXP stands to benefit massively as the electrification and autonomy changes to the automotive industry. Recent shortages have increased eyes on the industry and cause people all around the world to recognize the importance.

The Korea Times reported Samsung is starting to second guess this deal. The leader of Samsung, Lee Jae-young was released from prison early to lead Samsung forward. No acquisition can move forward without his approval, so his release was necessary to acquire NXP, or do any new major investments.

President Moon said he understood the criticism regarding the release of the Samsung vice chairman, but at the decision was based partly on the country's expectations for Lee's increased contribution to tackling chip shortage and vaccine supply issues.

The alleged second guessing is because NXP is too expensive. The automotive shortages and all the commentary surrounding it as well as rumors of a deal have cause NXP to soar in valuation. Samsung is likely to make deals and investments with their humungous $120B+ pile of cash & other liquid investments, but perhaps they target other semiconductor firms.

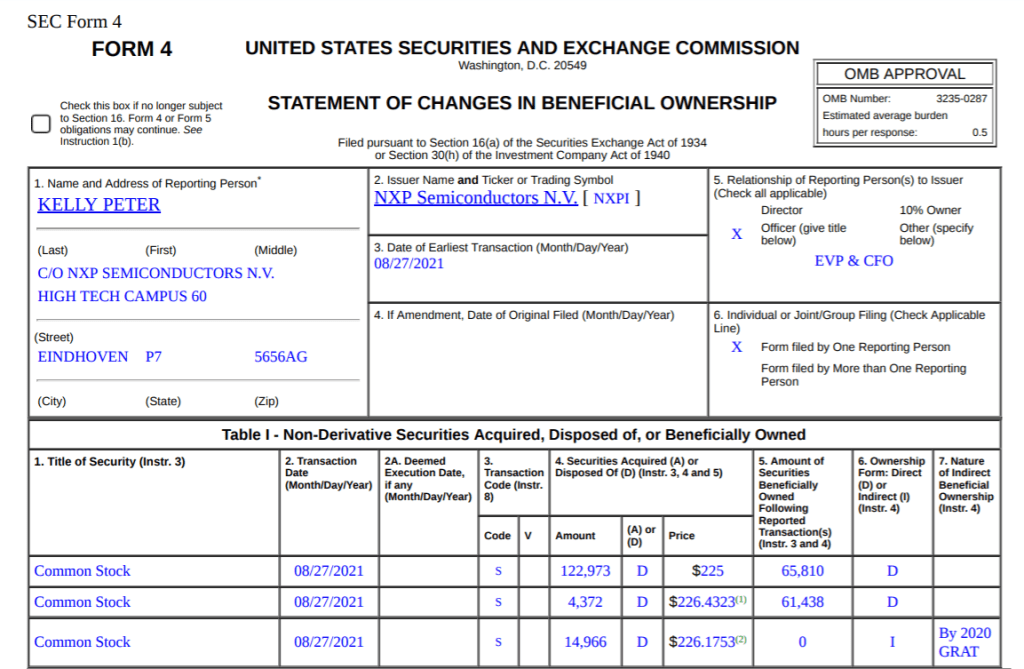

The CFO of NXP, Kelly Peter sold 142,311 of his 203,749 shares. This is a shocking amount of stock and far more than any previous sale by insiders in recent recorded history. Selling 69.85% of your shares all at once right after rumors of a Samsung acquisition falling apart is not a good look.

The CFO is going to be one of the ones who has discussed this deal directly and would know the current status. He is also in charge of the capital return policy, and as such, he has had NXP spend more than 100% of their cash they generated on buybacks of stock. The unsustainable share buybacks has also contributed to the soaring share price.

Maybe there is another, completely justifiable reason a 10+ year executive needed $32M all at once, but SemiAnalysis did not find one. While he is retiring in February of 2022, the timing and size is still suspect. We aren’t saying this is insider trading, we will leave that up to regulators, but we can’t rule out the possibility either. NXP did not respond when we requested a comment.

This article was originally published on SemiAnalysis on August 31st 2021.

Clients and employees of SemiAnalysis may hold positions in companies referenced in this article.

$ON?