Micron has announced to sell their Lehi, Utah Fab to Texas Instruments. Micron claims the price is $1.5B, but the Texas Instruments press release says $900M. Micron says this discrepancy of $600 million is in the from of value from select tools and other assets. Micron will retain these tools and assets, which they can move to other sites or sell to other firms. In essence, Micron is claiming they are selling the entire fab to TI, and TI is paying them $900M cash and $600M in tools and other assets that are located at this fab.

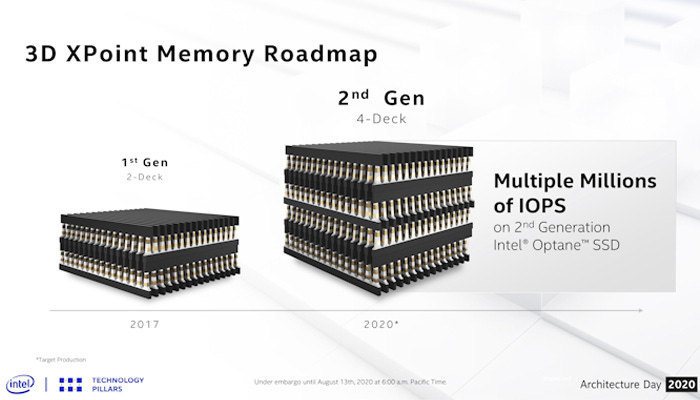

This fab has long since plagued Micron as it is a byproduct from the Intel/Micron IMFT joint venture. It has driven many write downs and losses for Micron from underutilization. This fab was the home of 3D X-Point and some NAND operations. Intel currently purchase all of their 3D X-Point from this fab. SemiAnalysis expects Intel to begin to ramp the 4 layer 2nd generation X-Point at their New Mexico fab. Intel recently announced $3.5B of investments at this fab. This $3.5B will go towards fab modernization, and Intel specifically mentioned advanced packaging technology such as EMIB and Foveros. We suspect some of these investments will also make their way towards silicon photonics and ramping 3D X-Point.

Texas Instruments is offering every Micron Lehi, Utah employee the opportunity to become an TI employee. Texas Instruments does not receive any IP or licensing agreement for X-Point. Instead they will be investing in this fab for 65-nm and 45-nm production for TI's analog and embedded processing products. This will be their 4th 300mm wafer fab. Currently TI has two 300mm fabs with their DMOS6, RFAB1 fabs. RFAB2 is under construction and will be completed soon.

The companies plan for the sale to complete by the end of 2021. This fab will be fairly empty because Micron is not transferring $600M of tools and other assets. Texas Instruments says they will be incurring underutilization costs of about $75 million per quarter in 2022. This fab will be built out over 2022 with Texas Instruments own tools as it is fitted out for their processes rather than the X-Point and NAND tools currently in place. First revenue from this fab is expected in early 2023.

This article was originally published on SemiAnalysis on June 30th 2021.

Clients and employees of SemiAnalysis may hold positions in companies referenced in this article.

"Micron will retain these tools and assets, which they can move to other sites or sell to other firms. In essence, Micron is claiming they are selling the entire fab to TI, and TI is paying them $900M cash and $600M in tools and other assets that are located at this fab."

🤨

Hello sir, this is the IRS.