Lam Research is one of the most dominant semiconductor capital equipment firms. Lam Research has rapidly gained total wallet share in the semiconductor manufacturing capital expenditures market. From 2015 to 2021, Lam Research has grown from 9.3% to 12.7% of total spending. We have also been big fans of their efforts at gaining share with expertise around etch, deposition, and electroplating, and we expect them to continue to gain share in highly selective etch, atomic layer deposition, and photoresist coaters/developers.

In 2015, Lam Research had $5.26B of revenue, and they are expected to earn nearly $17B in revenue this year. This has required massive capacity expansions. While they have expanded at existing locations in the US, Taiwan, and South Korea, Lam Research’s largest expansion is in Malaysia. We were asked why Lam Research is outsourcing so much of their new production to Malaysia especially given the pro-CCP attitude of the current Malaysian government. It seems like a potential national security issue, but we will leave that for others more politically inclined to speculate about that. Instead, we want to drill down into the total manufacturing square footage Lam Research has and their public comments about the facility in Malaysia.

Malaysia facility, our largest and most advanced facility

Lam Research (2022)

The opening of the facility in Batu Kawan Penang, Malaysia late last year almost single-handedly grew Lam Research’s total manufacturing square footage by nearly 50%! As such, Lam Research has been shy to state how large this facility is relative to their other facilities.

How much of your manufacturing is U.S.-based versus international?

Stacy Rasgon (2020)

We don't disclose exact percentages, but we have large manufacturing facilities in California and Oregon, but also a large manufacturing facility in Korea, manufacturing in Taiwan, in Austria, and we just started building a very large facility in Malaysia that will come up middle of next year.

Timothy Archer, Lam Research President & CEO (2020)

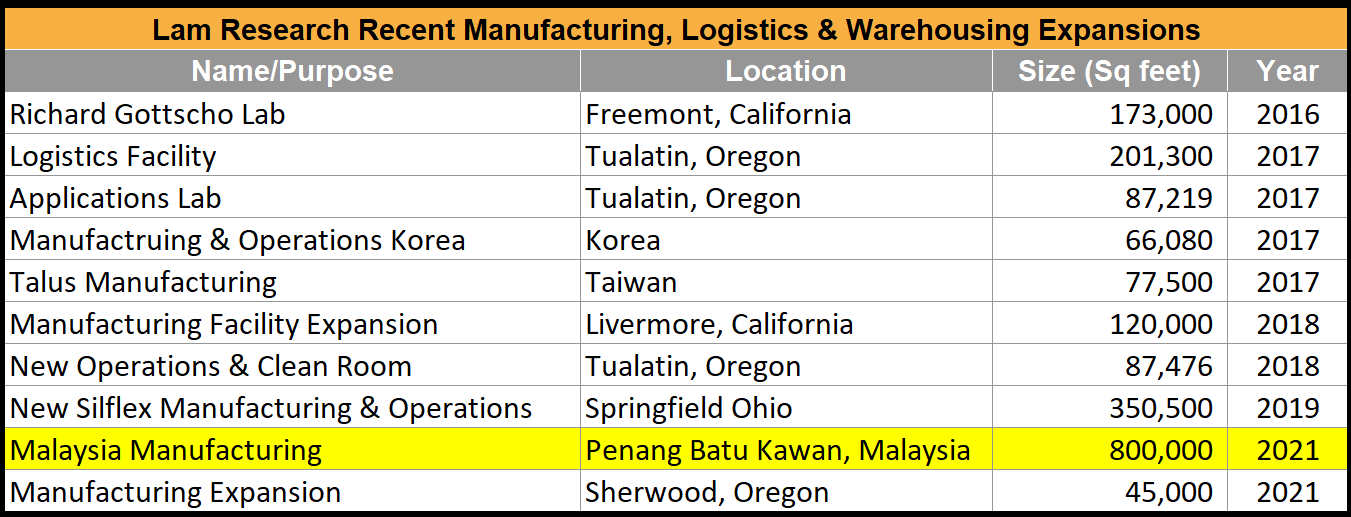

We went through various company information as well as to various local county assessor’s office information to pin down how large the existing facilities are. Here is a list of manufacturing and warehouse growth over the last handful of years for Lam Research. These facilities are what’s enabled Lam Research to more than triple their revenue since 2016.

Malaysia stands out as much larger than other facilities. Furthermore, Lam Research has only said it is for manufacturing where as some of the other larger new facilities include descriptions of operations and logistics. In 2021, Lam Research added ~845,000 square feet of manufacturing space which increased Lam Research’s total manufacturing and warehousing square footage by nearly 50%. As such it stands to reason more than 1/3 of Lam Research’s future manufacturing capacity will be in Malaysia.

The ramp is very much on track. It eventually -- once it's fully ramped, the factory in Malaysia, will be the largest factory in our network, not today.

Tim Archer, Lam Research President & CEO (2022)

Furthermore, Lam has only just started to ramp their Malaysia facility. It is likely that in 2023 or 2024, if the total wafer fabrication equipment market shrinks in size, Lam Research will continue to fill out their Malaysia facility due to better cost structure versus their American facilities. Does this mean that other locations, especially in the United States, will start to cut jobs in favor of the lower cost manufacturing location?

These jobs in Malaysia are not simple assembly jobs either. Lam Research has stated they will have around 600 people working in the Malaysia facility which will be manufacturing billions of dollars of equipment every year. The total labor cost as a percentage of their cost of goods sold will be tiny. These are high value and high skill jobs.

For comparison, Lam Research’s largest competition, Applied Materials, is in the process of finalizing plans for a $2.4B facility expansion in northeast Austin Texas. Their current facility near Austin employs 2,500 people, but the expansion would add hundreds more jobs for research, development, and manufacturing.

So why is Lam Research outsourcing jobs despite their main competitor expanding domestically?

There’s 3 main reasons, there is a perceived lack of skilled workers in the US, lower cost labor and operations, and lower logistics costs. The reasoning has also been openly explained by the CEO.

One, it's closer to the customer base. So even though we're still going to be flying things, we're going to be flying things a shorter distance. So there's some level of benefit there. And obviously, I think everybody on the webcast knows, Malaysia is a lower-cost location. So we're going to benefit from that in addition to the fact that we're bringing the supply chain along with us to Malaysia.

Tim Archer, Lam Research President & CEO

Suppliers of Lam Research will also likely be told to move to Malaysia as a method of lowering costs.

The ultimate goal is for Lam Research is higher gross margins on the tools they sell, but the externalities of this decision cannot be overlooked. The US will continue to lose semiconductors, not only in chip manufacturing, but also in the expertise related to tool production. Furthermore, rather than going to low cost allies of the US, a huge national security hole is being opened. The pro-CCP government of Malaysia is a big beneficiary from this movement of some of the tech manufacturing in the world. We won’t fault Lam Research for the move as it’s clearly driven by US policy failures on tax, education, and manufacturing, but we do want to bring attention of this to our readers.

I think you are perhaps excessively worried about Anwar and his coalition being Pro CCP and therefore investments in Malaysia are a security risk. The country is a democracy has political cleavages, this government may not even last a whole term it doesn't even have a true majority. post election there was crisis in forming the government A new govt may form and pivot on policy. Essentially if you worry about investments in any country in Asia, then to some extent using that logic all of them are at risk including the closest that isn't Taiwan, Singapore (South Korea and Japan are treaty allies). No state in Asia is particularly thrilled about having to make a choice between security and economy, which is the choice they feel they are being forced to make by US China competition. LAM according to this piece seems fairly savvy and made a decision based on competitiveness. The way to deal with that is as you have laid out previously in other posts is ensure the US can compete as a destination by any and all means necessary.

The point is not so much CCP or China or Chinese workers, as some of the comments pointed out. Let's not ignore the fact that Lam's customers are not consumers, they are TSMCs UMCs Samsungs Microns etc, and the bulk of their fabs are almost all located in Asia except probably Intel. Why didnt Applied Materials move as well? I don't know, maybe it is planning something too. As regard to skilled work-force, TSMC made similar comments on their delayed fab construction in Arizona. I am not sure policy tax or education is help much quickly, even if all the politicians can be persuaded to move in unison. There's a much easier solution: giving more immigration visas, encouraging young skilled engineers and workers to move their family from Asia to US or even Europe, if one plans to build fabs there. Lure them with higher income, better healthcare, better work conditions, freedom and better education for their kids.